David Fender

Farmers Agent in Florida

Purchasing Leads for:

3 years

Monthly Budget:

$15,000

# Sales Producers Working Internet Leads:

4 of 5 total

Territory Size:

Full State

Lead Types:

Home, Auto

CRMs:

APEX, VanillaSoft

David Fender, a Florida Farmers agent, recently made the decision to let go of one of his lead providers, a close competitor to QuoteWizard (“Competitor”), and put nearly all of his leads budget towards QuoteWizard leads. He agreed to share his data with us, which we will be showcasing in this case study.

David had been implementing lead-purchasing best practices by keeping detailed records of his contact, quote, and close rate over time across his providers. At the time that he was still purchasing from Competitor, his office was sourcing about 70% of their leads from QuoteWizard (350 leads/wk), and 15% from Competitor (75 leads/wk).

| Provider | Budget Allocation | # Leads/Wk |

|---|---|---|

| QuoteWizard | 70% | 350 |

| Competitor | 15% | 75 |

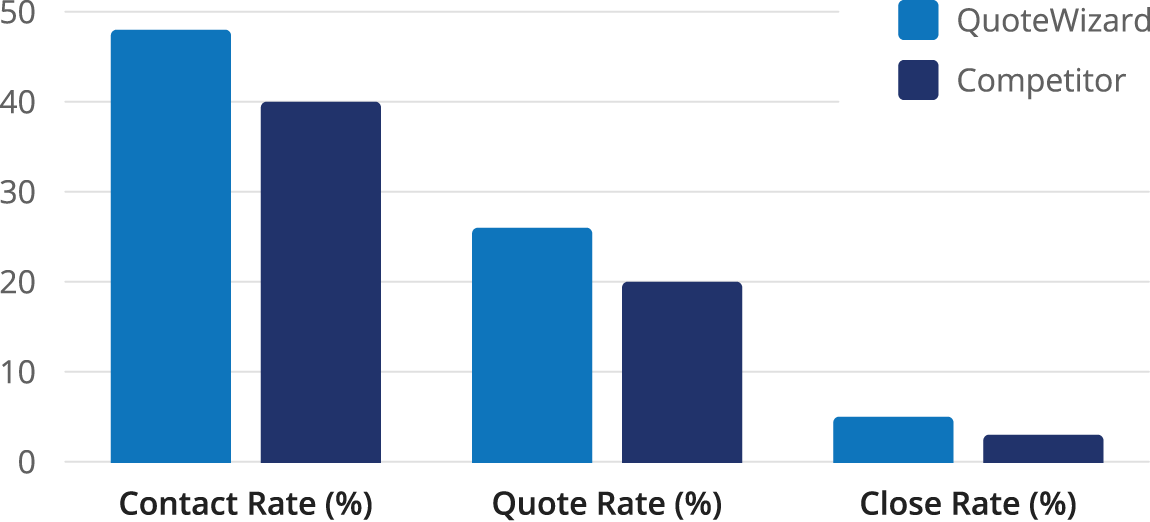

As you can see from the table below, David’s team found that QuoteWizard leads were contacted 20% more frequently than Competitor’s leads, had a quote rate that was 30% higher than Competitor’s leads, and showed a 66% better close rate when compared to Competitor’s leads. The significant difference between these metrics ultimately helped David make the choice to move his marketing dollars from Competitor to QuoteWizard.

The industry standard for close rates on web leads typically falls between 2–3%, meaning David’s average close rate with QuoteWizard beat the national average by 66–150%! We asked him to shed some light on his experience, including what elements aid him in his success.

QW: You’ve stated that you have 4 of your 5 sales producers working leads, each receiving 20 new internet leads per day. Can you shed some light on your team’s sales cycle process for working these?

DF: “Our CRM [VanillaSoft] manages a ‘last-in-first-out’ workflow for our leads. On a home lead the producers will take a few minutes to review the risk before dialing. On auto, they dial immediately. If we do not make contact, [VanillaSoft] manages a 7-step cadence process that lasts two months.”

QW: What major differences did you experience between purchasing QuoteWizard leads and Competitor’s leads?

DF: “We find in internet leads there is always a mix of people that tell us they did not initiate a request for an insurance quote. Currently, with QuoteWizard, we are not running into that objection as much as we are seeing with other lead vendors.”

QW: What advice do you have for agents who are new to the leads business?

DF: “Pay attention. Internet leads are constantly changing both in quality and price. Track your results and keep communication open with the lead vendors and adjust your program as needed.”

QW: Aside from better success metrics, what other reasons, if any, influenced your decision to move more marketing dollars towards QuoteWizard leads?

DF: “Pricing was helpful, but results are king, and currently we are getting better results from QuoteWizard leads. [Additionally,] the team at QuoteWizard has always been very helpful as we continue to learn about internet leads and how best to use them.”

© QuoteWizard

157 Yesler Way, Ste 400

Seattle, Wa 98104

QuoteWizard is a

LendingTree company.